Have you recently looked into the cost of purchasing a health insurance policy? If you did, were you surprised by all the jargon you had to sift through as you examined your options? You probably asked yourself, “What’s the difference between an HMO and a PPO plan?”, “What’s considered a reasonable deductible?” and most importantly, “Does my current medical provider accept this type of plan?” I’m not in the business of selling insurance, so if you came here looking for answers to these types of questions, I’m not going to be much help. Wait! Before you click that back button, I implore you to keep reading. I have good news for you! I promise what comes next may save you a significant sum of money, and who doesn’t like saving money?

When Congress passed the Affordable Care Act (ACA), aka “Obamacare”, it spurred on the creation of a healthcare marketplace. The marketplace is a one-stop shop for taxpayers who wish to purchase medical insurance plans at a more competitive price than they used to. One way the marketplace makes insurance more “affordable” is through what’s known as a “premium assistance credit”, which is just a fancy way of saying the government will pay for a portion of your monthly health insurance premiums, and you just have to pay the difference.

In order to qualify for a premium assistance credit, you have to tell the marketplace what your estimated modified adjusted gross income (MAGI) will be for the year. I know… another acronym… allow me to simplify this one for you.

Step 1:

Add up your total income from the following sources:

- W-2 Income (Salaries & Wages)

- Investment Income (Interest, Dividends, Capital Gains)

- Business Income (Net Schedule C Income, Net Pass-through Income)

- Retirement Income (IRAs, Pensions, Social Security)

- Rental Income

Step 2:

Add up your total “adjustments” from the following sources:

- Educator Expenses

- Health Savings Account Contributions

- Health Insurance Expenses (Self-Employed)

- IRA Deductions

- Student Loan Interest

Step 3:

Take your total income from Step 1 and subtract your total adjustments from Step 2. That, my friends, is how you calculate your MAGI.

Now that you’ve calculated your MAGI, you can move on to the fun part. Saving money!

How many people do you live with? Will they show up as a dependent on your tax return this year? Why, oh, why must there be so many questions? I know… The reason you have to ask yourself this is because it helps dictate the value of how much financial help you’ll get from the government.

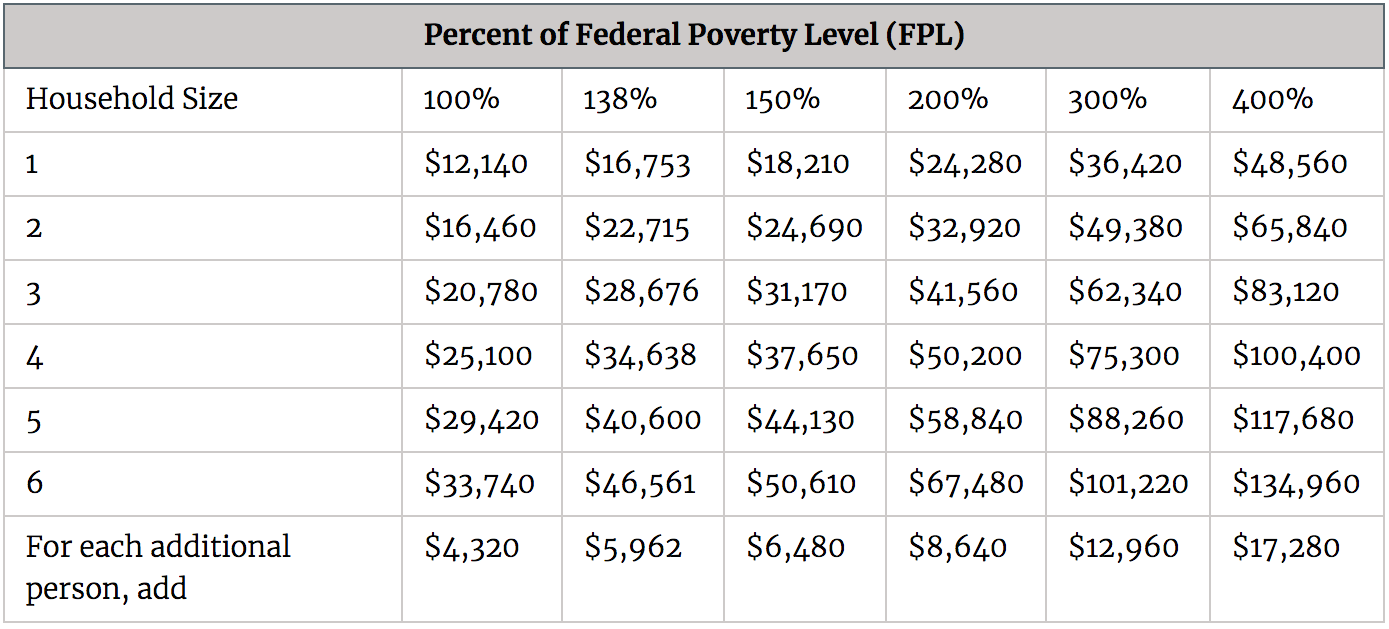

Let’s assume that you have three people in your household in 2019, and all three of you will be listed on your tax return. Based on the chart below, that means your 2019 MAGI cannot exceed $83,120 if you wish to receive any help paying for your health insurance premiums.

What happens if your MAGI exceeds 400% of your household size? Good question! If you received even one dollar of premium assistance during the year, and your MAGI exceeds 400% of your household limit, then you have to pay back every single dollar of assistance you received when you filed your tax return. For some people that could mean owing more than $10,000 when they file their tax return.

One of the worst feelings in this business is having to tell someone they owe that kind of money. On the flipside, one of the best feelings in this business is educating someone on how to avoid this kind of financial catastrophe.

Now that you know what MAGI is, what should you do next? I’m glad you asked. I’d recommend calling Cassidy CPA at (843) 689-2800 in order to talk about your MAGI and any other tax questions you may have.

By Mark Plumlee, CPA

*DISCLAIMER*

- The chart listed above is only applicable for the 2019 calendar year.

- This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.